📌 Finance Control 2025: TL;DR

Swipe through the full guide in under 60 seconds.

• Finance control = owning your money, not letting it control you.

• Budget, track, automate, and invest with intention for 2025.

• Rising living costs and shifting job markets strain budgets.

• Most people operate without a clear plan or financial structure.

• Lack of control leads to debt, stress, and stalled goals.

• Small systems beat motivation: automation, budgeting, and consistent tracking.

• Digital tools now make money management easier than ever.

• Financial growth happens through habits, not big moments.

• Build your 2025 monthly budget today (income → expenses → savings).

• Automate bills, transfers, and investments.

• Start a 3–6 month emergency fund immediately.

• Clear mind, reduced stress, and full visibility over your finances.

• Faster progress toward goals like home ownership or debt freedom.

• Stronger long-term security and wealth-building momentum.

• Master your money and you unlock more freedom, choices, and opportunities.

• Budget smart. Track consistently. Automate everything you can.

• Eliminate high-interest debt first.

• Build savings, then invest for long-term growth.

• Finance control is the foundation of financial freedom in 2025.

Managing your finances effectively has never been more critical. Rising living costs, shifting employment landscapes, and the ever-present need for future security make finance control, financial management, and budget management indispensable skills.

| 💡 In a Nutshell | |

|---|---|

| What Is Finance Control? | Managing your income, expenses, and savings with clear budgeting and spending plans. |

| Why It Matters | Builds financial stability, reduces stress, and empowers you to reach your goals. |

| Key Steps | Track expenses, create budgets, set saving goals, and review regularly. |

| Tools to Use | Budget apps, spreadsheets, financial planners, and automated alerts. |

| Get Started Today | Begin by reviewing your last month’s spending and setting a realistic budget. |

In this guide, we’ll break down every element of money management—from creating a personalized budget to investing for long-term growth—so that you can confidently control your finances and steer your financial journey.

“Wealth is not about having a lot of money; it’s about having a lot of options.” — Chris Rock

📊 Finance Control: Verified Statistics 2025

- Personal Finance Management Source: Federal Reserve (FRED) https://fred.stlouisfed.org/ ✓

Key Statistics: • Personal Savings Rate: 3.4% • Household Debt Service Payments as Percent of Disposable Personal Income: 9.8% • Consumer Price Index Change: +2.3%

- Digital Financial Management Source: World Bank Global Findex Database https://globalfindex.worldbank.org/ ✓

Key Findings: • 76% of adults globally now use digital payments • 92% of adults in high-income economies use digital financial services • Mobile banking adoption increased by 43% since 2020

- Financial Technology Impact Source: Statista Financial Services https://www.statista.com/markets/414/finance-insurance-real-estate/ ✓

Latest Data: • 65% of Gen Z prefer mobile banking solutions • 78% use at least one fintech app for money management • Digital payment transactions increased by 27% annually

Understanding Finance Control

💡 Definition Snippet: Finance control involves overseeing income, expenditures, and investments to maintain financial stability and growth. Effective finance control not only prevents excessive debt but also lays the groundwork for achieving significant financial milestones.

Why This Matters: When you practice finance control, you effectively shape your spending habits, savings patterns, and investments so you can achieve your personal finance goals—whether that’s buying a home, traveling, or retiring early.

Why Finance Control Matters

“A budget is telling your money where to go instead of wondering where it went.” — Dave Ramsey

- Stress Reduction: Clarity over income, expenses, and investments diminishes the mental burden of guessing where your money is going.

- Goal Fulfillment: Proper money management ensures you have the resources to reach significant milestones, like purchasing a car or launching a business.

- Long-Term Security: An organized financial framework helps you accumulate wealth over time and safeguards against unforeseen emergencies.

The Essence of Budget Management

💰 Budget management is the practical expression of finance control. It means allocating your income into categories that align with your lifestyle and objectives, ensuring you spend within your means while setting aside money for future growth.

- Identify Income Sources: Salaries, side hustles, rental income—sum these up to see your total monthly revenue.

- Track Expenses: Keep a record of every outgoing penny. Don’t forget yearly costs like insurance or property tax.

- Design Your Budget: Separate spending into essentials (housing, utilities, groceries), discretionary expenses (entertainment, hobbies), and savings or investments.

- Adjust Regularly: Budgets aren’t static. Life changes, and so will your financial obligations.

For a deeper dive, check out Investopedia’s Budgeting Basics.

Setting Realistic Financial Goals

🎯 Financial goals give you a roadmap to guide every budget, expense, and investment decision:

- S.M.A.R.T. Goals: Specific, Measurable, Achievable, Relevant, Time-bound. Instead of “I want to save,” try “I will save $5,000 in 12 months.”

- Short-Term vs. Long-Term: Short-term goals (3–12 months) might be paying off a credit card, while long-term goals (5–20+ years) might be retirement planning.

- Frequent Check-ins: Evaluate your progress monthly or quarterly. Realign goals if you’re lagging behind or if your financial situation changes.

“If you can dream it, you can do it.” — Walt Disney

Creating a Personalized Budget

📝 Budget management becomes personal when it reflects your unique lifestyle:

- Fixed Expenses: Rent, mortgage, car payments—these are non-negotiable.

- Variable Expenses: Gas, groceries, utilities fluctuate monthly. Monitor these closely.

- Discretionary Spending: Things like entertainment and dining out keep life enjoyable, but set limits to stay on track.

- Savings and Investments: Pay yourself first. Automate contributions to savings or retirement accounts.

This customized approach helps ensure you don’t feel deprived but still move forward toward your personal finance goals.

Leveraging Finance Control Tools

📱 In a digital era, numerous apps and tools can simplify managing your finances:

- Budgeting Apps: Mint, YNAB (You Need A Budget), and EveryDollar can automatically categorize transactions.

- Expense Trackers: Tools like Spending Tracker keep tabs on daily outlays, uncovering hidden leaks.

- Spreadsheets: Google Sheets or Microsoft Excel for those who want in-depth control and custom formulas.

- Automation: Set up autopay for bills, automated savings transfers, and auto-investing for consistent progress.

Money-Saving Tip: Harness these tools to minimize manual mistakes and maintain momentum toward your financial goals.

Pro Tip: Looking for the best tools to implement these strategies?

👉 Explore our hand-picked Best Budgeting Apps for 2025

Taming Expenses: Strategies to Cut Costs

✂️ Expense control is key to effective financial management. Small savings add up quickly:

- Negotiate Bills: Cable, internet, even credit card APRs can sometimes be lowered with a polite request.

- Opt for Generic: Branded items often come with a premium. Try store-brand groceries or household products.

- DIY Mindset: Basic home repairs and cooking at home can save thousands annually.

- Audit Subscriptions: From Netflix to gym memberships, cut what you don’t use regularly.

- Practice Delayed Gratification: Wait 24 hours before making non-urgent purchases.

Harnessing the Power of Debt Management

💳 Debt can serve as a tool (e.g., student loans, mortgages) or a drain (high-interest credit cards):

- List Debts: Note balances, interest rates, and minimum payments.

- Focus on High-Interest First: Pay down highest APR debts to save on finance charges.

- Debt Consolidation: Consider combining multiple debts into a single low-interest loan.

- Snowball vs. Avalanche: The Snowball method tackles smaller debts first; the Avalanche method tackles higher interest debts first. Both aim for faster payoff.

- Seek Guidance: If overwhelmed, look for a reputable credit counseling agency. Visit the National Foundation for Credit Counseling for more info.

“Beware of little expenses. A small leak will sink a great ship.” — Benjamin Franklin

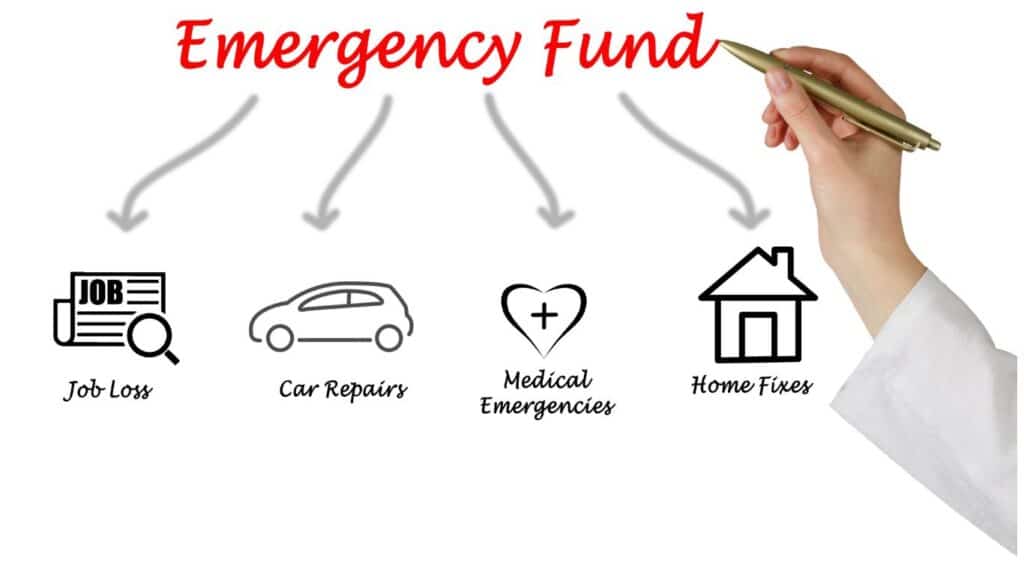

Building an Emergency Fund

🔒 An emergency fund ensures unexpected expenses (car repairs, medical bills) don’t derail your personal finance plan:

- Aim for 3–6 Months’ Expenses: Job stability, family size, and other factors can change this figure.

- High-Yield Savings: Keep emergency funds accessible yet separate from your main checking.

- Automate Contributions: Schedule monthly transfers to stay consistent.

- Guard It: Only use for genuine emergencies, not for vacations or gadget upgrades.

Pro Tip: Want to put these finance control strategies into action?

👉 Join our popular 30-Day Money Reset Challenge and see results in just one month!

Investing for Growth

🌱 Once your debt is manageable and you have an emergency fund, it’s time to grow your money:

- Retirement Accounts: Contribute to a 401(k) or IRA. If your employer matches contributions, don’t miss out on that free money.

- Index Funds and ETFs: Passive investments that track market indices, offering diversification at low cost.

- Real Estate: From rental properties to REITs, real estate can build long-term wealth.

- Dollar-Cost Averaging: Invest a fixed amount regularly to even out market fluctuations.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

Get Your Free Financial Control Workbook

Download our comprehensive workbook to track your finances, set money goals, and create a solid financial future

Download Free Workbook

Tracking Your Net Worth

📊 Your net worth—assets minus liabilities—provides a snapshot of your overall financial health:

- Assets: Cash, investments, property, and any other valuables you own.

- Liabilities: Mortgage, credit card debt, student loans, car loans, etc.

- Monitor Regularly: Calculate quarterly or monthly to see if your wealth is growing over time.

- Motivation and Warning: A growing net worth is encouraging, while a stagnant or declining net worth signals the need for change.

Long-Term Financial Planning

🕰️ Life is dynamic, and so are your financial needs:

- Retirement Goals: Determine how much income you’ll need in retirement. Use free calculators on sites like Bankrate to estimate.

- Education Funding: 529 plans or other vehicles to fund college for you or your children with tax advantages.

- Insurance: Health, life, disability, and long-term care insurance can protect against catastrophic costs.

- Estate Planning: A will and healthcare directives ensure your wishes are followed if something unexpected happens.

Understanding Credit and Credit Scores

🏦 Credit scores open or close doors to future borrowing at favorable rates. Maintaining a high score pays off in lower interest costs:

- On-Time Payments: Never miss a due date.

- Low Credit Utilization: Aim to use less than 30% of your available credit limits.

- Long Credit History: Keep older accounts open to lengthen your average credit age.

- Credit Mix: A blend of revolving (credit cards) and installment (loans) can boost your score.

- Regular Checks: Visit AnnualCreditReport.com to spot any inaccuracies.

Pro Tip: Want to strengthen your financial foundation?

👉 Learn the exact steps to improve your credit score and achieve true financial freedom

Automating Financial Management

⚙️ Automation reduces manual errors and ensures consistency:

- Automatic Bill Pay: Avoid late fees by scheduling monthly utility, insurance, and loan payments.

- Auto-Invest: Contribute a fixed sum to investments each month, letting compound interest work wonders.

- Savings Triggers: Round-up apps or scheduled transfers are great for incremental savings.

- Online Monitoring: Use your bank’s or credit card’s app to quickly catch irregularities.

Fostering a Growth Mindset Around Money

🧠 Our mental approach to money management is just as important as any spreadsheet:

- Celebrate Milestones: Paid off a credit card or reached a savings goal? Treat yourself modestly to stay motivated.

- Continuous Learning: Books, podcasts, and blogs keep you informed of best practices and trends.

- Positive Influences: Surround yourself with people who value financial responsibility.

- Self-Education: “Formal education will make you a living; self-education will make you a fortune.” — Jim Rohn

Common Financial Management Mistakes to Avoid

🚫 Even careful planners stumble:

- Impulse Purchases: They can spiral into substantial debt.

- Skipping Insurance: One accident can wipe out years of savings.

- Overusing Credit Cards: High-interest debt can snowball quickly.

- Emotional Investing: Fear or greed often leads to mistimed market moves.

- Neglecting Retirement: The earlier you start, the more you benefit from compounding growth.

Embracing Financial Literacy

📚 Financial literacy is your best defense against scams and poor decisions:

- Free Online Courses: Platforms like Coursera and edX offer finance and investment modules.

- Local Workshops: Community centers frequently hold events on budgeting, credit building, and more.

- Books & Blogs: Titles like Rich Dad Poor Dad or blogs like Mr. Money Mustache provide unique perspectives on money.

- Up-to-Date Knowledge: Tax laws, interest rates, and market trends change. Stay informed to keep your plan relevant.

Creating Multiple Income Streams

💼 Relying on one paycheck can be risky:

- Side Hustles: Turn a skill—like writing, design, or tutoring—into extra income.

- Passive Income: Dividend stocks, rental properties, or peer-to-peer lending generate returns with minimal ongoing work.

- Gig Economy: Platforms like TaskRabbit, Fiverr, or Upwork let you monetize your spare time.

- Digital Products: E-books, online courses, or print-on-demand merchandise offer scalable income potential.

Pro Tip: Want to accelerate your financial goals?

👉 Learn how our community members are thriving with these proven side hustle strategies

Smart Tax Planning

💼 Proactive tax strategy is a crucial part of financial planning:

- Maximize Deductions/Credits: Mortgage interest, education credits, and more can lower your taxable income.

- Withholding Adjustments: Tweaking your W-4 can reduce year-end surprises.

- Retirement Contributions: Lower taxable income by contributing to a Traditional IRA or 401(k).

- Professional Advice: For complex situations (business, foreign income, multiple properties), consult a CPA or tax attorney. Visit the IRS official website for updates.

Retirement and Estate Planning

⌛ Retirement planning isn’t just for seniors:

- Start Now: Every year counts when compounding is in play.

- Diversify: Stocks, bonds, real estate, and other vehicles distribute risk.

- Catch-Up Contributions: If you’re over 50, consider taking advantage of higher retirement contribution limits.

- Estate Documents: A will, living trust, and power of attorney ensure your legacy aligns with your wishes.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

Navigating Inflation and Economic Changes

📈 Inflation can slowly erode your purchasing power:

- Budget Adjustments: Update allocations if essentials (groceries, gas) become pricier.

- Inflation-Proof Investments: TIPS (Treasury Inflation-Protected Securities) or real estate can hedge against inflation.

- Stay Informed: Watch economic indicators to strategize major purchases or investments.

- Adapt Long-Term Goals: Factor higher costs of living into retirement plans or education funding.

Handling Financial Windfalls Responsibly

🎉 From a bonus at work to an inheritance, a financial windfall can speed up your wealth-building—if managed well:

- Park It: Place it in a high-yield savings account while you plan.

- Eliminate Toxic Debt: Pay off high-interest credit cards or loans.

- Invest and Save: Funnel a portion into long-term assets or emergency reserves.

- Small Treat: Reward yourself modestly to keep from overindulging.

The Importance of Mindful Spending

🌟 Align your spending with your personal values:

- Identify Priorities: Spend more on what you genuinely enjoy, less on what doesn’t matter.

- Quality Over Quantity: Higher-quality items often last longer, saving money in the long run.

- Pause Before Purchasing: A simple 24-hour rule can curb impulse buys.

- Social Traps: Keep in mind Will Rogers’ advice: “Too many people spend money they earned…to buy things they don’t want…to impress people that they don’t like.”

Overcoming Psychological Barriers to Financial Management

🧭 Sometimes, self-sabotage blocks money management progress:

- Identify Spending Triggers: Stress, boredom, social pressure—avoid or adapt to them.

- Accountability: Share goals with a mentor or friend who checks in on your progress.

- Reward Progress: Tiny celebratory treats can reinforce positive habits.

- Seek Professional Help: Financial therapists or counselors can tackle emotional money issues.

Technology and Security in Financial Management

🔒 Embrace technology while staying secure:

- Strong Passwords: Use alphanumeric passwords and a manager like 1Password or LastPass.

- Two-Factor Authentication: Safeguard your bank and investment accounts further.

- Monitor Statements: Quick detection of irregular transactions limits damage.

- Secure Networks: Avoid public Wi-Fi for sensitive transactions; use a VPN if necessary.

Financial Checkups and Plan Adjustments

🔄 Keep your financial plan agile:

- Monthly Budget Reviews: Check if spending aligns with goals.

- Quarterly Net Worth Tracking: Spot growth or downturns early.

- Yearly Financial Audit: Update insurance, estate documents, and investment allocations.

- Professional Input: An annual or bi-annual chat with a financial advisor can provide fresh perspectives.

Sustainable and Ethical Investing

♻️ Aligning profit with principles is increasingly popular:

- ESG Factors: Look for funds that emphasize environmental, social, and governance metrics.

- Impact Funds: Some mutual funds or ETFs specifically invest in companies with strong social responsibilities.

- Balanced Perspective: Ethical doesn’t mean unprofitable—many socially responsible companies offer competitive returns.

Navigating Market Volatility

🌐 Market ups and downs are inevitable:

- Stay the Course: If you’re diversified and investing for the long haul, hold steady during dips.

- Rebalance: Periodically adjust your asset allocation to maintain your desired risk tolerance.

- Emergency Fund: A healthy cushion lowers panic during market swings.

- Long-Term Vision: Historically, markets trend upward over extended periods.

Cultivating Generosity and Community Impact

🎁 Giving back can be part of your personal finance strategy:

- Scheduled Giving: Dedicate a portion of each paycheck to charities or causes you value.

- Volunteer: Even if funds are tight, time contributions can make a big difference.

- Community Investment: Support local businesses or initiatives, fostering economic and social well-being.

- Legacy Giving: Incorporate philanthropic goals into your estate plan.

“We make a living by what we get, but we make a life by what we give.” — Winston Churchill

Financial Success FAQ

- How do I start investing with minimal capital?

- Answer:

- Begin with low-cost index funds or ETFs 📊

- Use brokers that offer fractional shares 💎

- Set up automated contributions 🔄

- Start small but stay consistent 📈

- Focus on long-term growth 🎯

- Answer:

- Is debt consolidation always a good idea?

- Answer:

- Check its impact on your credit score 📊

- Consider any consolidation fees 💰

- Compare interest rates 📈

- Look at the new payment term ⏱️

- Consult a credit counselor 🤝

- Answer:

- How often should I review my budget?

- Answer:

- A monthly review is recommended

- Track spending patterns 📱

- Adjust category limits 📊

- Identify overspending quickly ⚡

- Update financial goals 🎯

- Make necessary changes 💪

- Answer:

- What if I struggle with emotional spending?

- Answer:

- Work with a financial therapist 🧠

- Join support groups 🤝

- Set personal spending rules 📝

- Find an accountability partner 👥

- Track emotional triggers 📱

- Answer:

- Should I invest or pay off debt first?

- Answer:

- Prioritize high-interest debt first 💳

- Take advantage of any employer 401(k) match 💰

- Build an emergency fund 🏦

- Pay down remaining debt ⚡

- Always keep up with minimum payments 📊

- Answer:

Conclusion and Next Steps

“Wealth consists not in having great possessions, but in having few wants.” — Epictetus

You now have a robust framework for achieving finance control, financial management, and budget management:

- Start Small: Build a simple budget and set short-term goals.

- Automate: Leverage technology to minimize day-to-day financial drudgery.

- Scale Up: Aim for multiple income streams, prudent investing, and a growth mindset.

- Stay Agile: Regularly review and adjust as life evolves.

By focusing on these fundamentals, you’ll not only control your finances but also shape a future that aligns with your aspirations. It’s time to take charge, one decision at a time, and pave the way to lasting financial freedom.

Master Your Finances: Essential Money Management Guides

- Save Money: 3 Steps to Financial Freedom

- Link: https://bestofmotivation.com/save-money/

- Highlights: Master the 50-30-20 rule for success 💰📊

- Credit Card Payoff Guide

- Link: https://bestofmotivation.com/credit-card-payoff/

- Highlights: Strategic debt elimination plan ⚡

- Motivation for Saving Money

- Link: https://bestofmotivation.com/motivation-for-saving-money-2/

- Highlights: Stay focused on your financial goals 💪

- Smart Shopping Tips

- Link: https://bestofmotivation.com/top-10-money-saving-tips-for-christmas-shopping/

- Highlights: Control spending while shopping 🛍️

Average Reading Time: 7–10 minutes per article (📚)