Navigating the financial landscape with bad credit can feel like an uphill battle. It’s a position that I, like many others, have found myself in, and I’ve learned that it requires a combination of strategy, knowledge, and perseverance. In this comprehensive guide, I will take you through the process of how to get a loan with bad credit, empowering you to overcome the hurdles that stand in your way.

Understanding the Impact of Bad Credit on Loan Eligibility

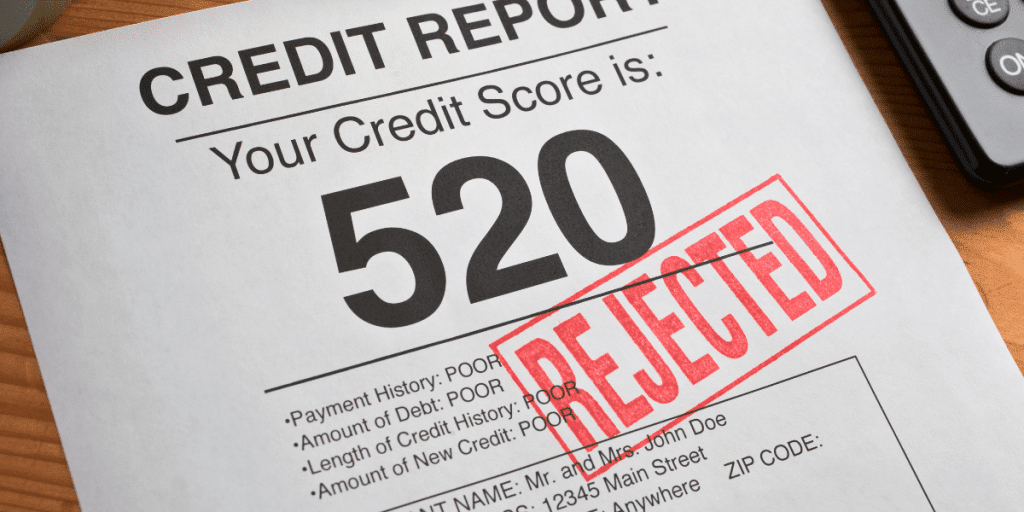

The Reality of Credit Scores and Borrowing

Credit scores are like the financial world’s gatekeepers, and bad credit can be a formidable barrier. When lenders look at your credit history, they’re trying to gauge your reliability as a borrower. A low score can set off alarm bells, signaling that you’ve had difficulties managing credit in the past. This can include missed payments, defaults, or even bankruptcies, which all suggest a higher risk for the lender.

How Lenders View Risk

For lenders, it’s all about minimizing risk. They want to ensure that they will get their money back, with interest. When your credit score is low, lenders see you as a higher risk, which can lead to either outright rejection or approval with less favorable terms. This might mean higher interest rates or additional fees, making borrowing more costly for you.

The Long-Term Effects of Bad Credit

Bad credit doesn’t just affect your ability to borrow; it can have a ripple effect on other areas of your life. It might mean higher insurance premiums, difficulty securing rental housing, and even challenges when applying for certain jobs. Understanding these implications is critical as you navigate the process of securing a loan.

Factors to Consider Before Applying for a Loan with Bad Credit

Assessing Your Financial Health

Before diving into the loan application process, take a hard look at your current financial situation. Assess your income, expenses, and existing debts. Understanding where you stand financially will help you determine how much you can realistically afford to borrow and repay without overextending yourself.

The Importance of Shopping Around

Not all lenders are created equal. Some might be more willing to work with individuals who have bad credit. Take the time to shop around and compare offers. Look beyond just the interest rate; consider the loan terms, fees, and any additional features or benefits that might be included.

Setting Realistic Expectations

When you have bad credit, it’s important to set realistic expectations. You may not qualify for the lowest interest rates, and you might need to provide additional documentation or security to get approved. Approach the process with an open mind and be prepared for the extra steps you may need to take.

Steps to Improve Your Credit Score Before Applying for a Loan

One of the most effective ways to boost your credit score is to pay down existing debt, especially high-interest credit card balances. This lowers your credit utilization ratio, which is a key factor in your credit score calculation. Aim to keep your credit card balances below 30% of your limits.

Timely Bill Payments

Your payment history accounts for a significant portion of your credit score. Ensure that you’re paying all your bills on time, every time. Even one missed payment can negatively impact your score. Set up automatic payments or reminders to help keep you on track.

Disputing Credit Report Errors

Errors on your credit report can unfairly drag down your score. Make it a habit to review your credit reports regularly and dispute any inaccuracies you find. Correcting these mistakes can give your credit score a much-needed boost before you apply for a loan.

Exploring Loan Options for People with Bad Credit

Secured vs. Unsecured Loans

When you have bad credit, secured loans might be more accessible than unsecured ones. Secured loans require collateral, such as a car or home, which the lender can seize if you default. This reduces the lender’s risk and can help you qualify for a loan with better terms.

Credit Unions and Community Banks

Credit unions and community banks often have more flexible lending criteria than larger banks. As member-focused institutions, they might be more willing to consider your entire financial picture beyond just your credit score.

Online Lenders and Bad Credit Specialists

There’s a growing market of online lenders and financial institutions that specialize in loans for people with bad credit. While these can be a viable option, it’s essential to tread carefully, as some may charge exorbitant interest rates or fees.

How to Secure a Loan with Bad Credit

Gathering the Necessary Documentation

When you apply for a loan, lenders will typically ask for proof of income, employment history, and identification. Having these documents ready can streamline the process. For those with bad credit, additional documentation may be required to demonstrate your ability to repay the loan.

Writing a Convincing Loan Application Letter

A well-crafted loan application letter can make a difference. Explain your financial situation, how you plan to use the loan, and how you intend to repay it. If there are extenuating circumstances that led to your bad credit, such as a medical emergency, be sure to mention them.

Demonstrating Stability and Repayment Ability

Lenders want assurance that you can repay the loan. Showcasing stability in your employment and residence, as well as having a solid repayment plan, can increase your chances of approval. Present a budget that clearly outlines your income, expenses, and how the loan payments fit into that budget.

Tips for Negotiating Loan Terms with Lenders

Understanding the Terms and Conditions

Before entering negotiations, make sure you fully understand the terms and conditions of the loan offer. Know the interest rate, the repayment period, any fees, and the monthly payment amount. This knowledge will empower you to negotiate more effectively.

Highlighting Your Strengths

If you have aspects of your financial situation that are strong, such as a stable job or significant income, highlight these to the lender. They can serve as leverage in negotiations, showing that you have the means to repay the loan despite your bad credit.

Being Prepared to Compromise

Negotiation is a two-way street. While you should advocate for the best terms possible, also be prepared to compromise. This might mean accepting a higher interest rate or providing collateral to secure the loan. Remember, the goal is to secure a loan that you can realistically manage.

The Importance of Collateral and Cosigners for Securing a Loan with Bad Credit

Using Collateral to Your Advantage

Collateral can be a powerful tool when securing a loan with bad credit. Offering an asset can provide the lender with the necessary security to approve your loan. Be mindful, though, as you risk losing that asset if you fail to repay the loan.

The Role of a Cosigner

A cosigner with good credit can significantly improve your chances of getting a loan. They agree to repay the loan if you can’t, which reduces the risk for the lender. Ensure that your cosigner understands the responsibilities and risks involved before agreeing.

The Risks and Rewards Involved

Both collateral and cosigners can help you secure a loan, but they come with risks. If you default on the loan, you could lose your collateral, and your cosigner could be left with the debt. Carefully consider these factors before proceeding.

Common Mistakes to Avoid When Applying for a Loan with Bad Credit

Ignoring the Fine Print

Never overlook the details in your loan agreement. The fine print can contain critical information about fees, penalties, and other terms that could impact you financially. Take the time to read and understand everything before signing.

Taking on More Debt Than You Can Handle

Just because you can secure a loan doesn’t mean you should. Borrow only what you need and what you can afford to repay. Taking on more debt than you can manage can lead to a cycle of debt that’s hard to escape.

Falling for Predatory Lenders

Unfortunately, there are lenders out there who prey on those with bad credit. Be wary of offers that seem too good to be true, like loans without a credit check or sky-high interest rates. Do your research and choose reputable lenders.

Alternative Options for Obtaining Funds with Bad Credit

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with individual investors who are willing to lend money. While these platforms still consider credit scores, they may have more lenient requirements than traditional banks.

Credit Builder Loans

Credit builder loans are designed to help you improve your credit score. The money you borrow is held in a bank account while you make payments. Once the loan is repaid, you get access to the funds, and your timely payments will have improved your credit score.

Borrowing from Family or Friends

Borrowing from family or friends can be a no-credit-check option, but it comes with its own set of risks. It’s important to treat the loan as seriously as you would from a bank, with clear terms and a written agreement to avoid any misunderstandings.

Conclusion: Empowering Yourself to Overcome Financial Challenges with Bad Credit

Taking Control of Your Financial Future

Securing a loan with bad credit is not an easy journey, but it’s not impossible. By understanding the impact of bad credit, considering the right factors, and taking steps to improve your credit score, you can put yourself in a better position to secure a loan.

Building a Stronger Financial Foundation

Every step you take toward securing a loan with bad credit is a step toward building a stronger financial foundation. Use this opportunity to develop better financial habits that will serve you well into the future.

Moving Forward with Confidence

Remember that bad credit is not a permanent state. With the right approach and a commitment to improving your financial health, you can secure a loan and move forward with confidence. Empower yourself with knowledge, and don’t let bad credit define your financial future.

Unlocking the power of motivation to overcome the challenges of bad credit is within your reach. Take these insights, apply them to your situation, and start your journey toward securing the loan you need. With determination and the right strategy, you can achieve your financial goals despite the obstacles that bad credit may present.